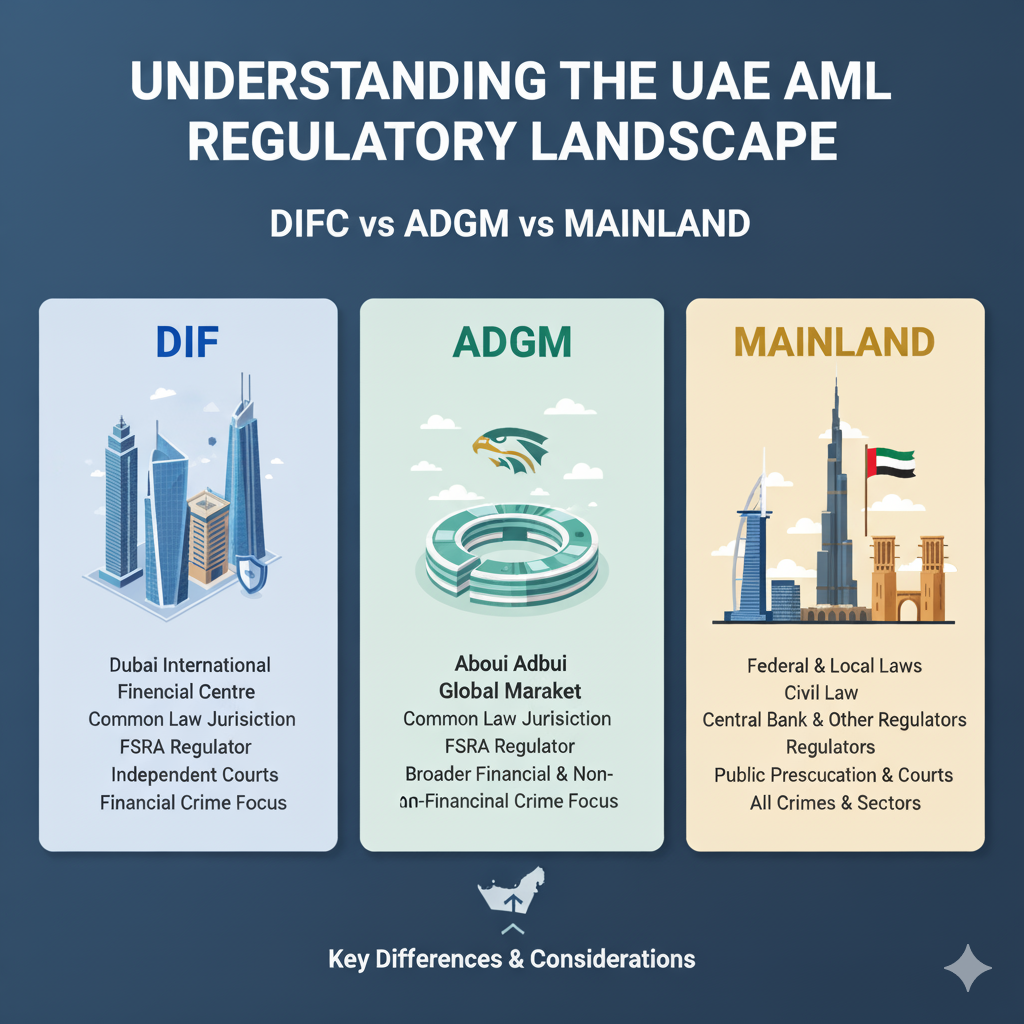

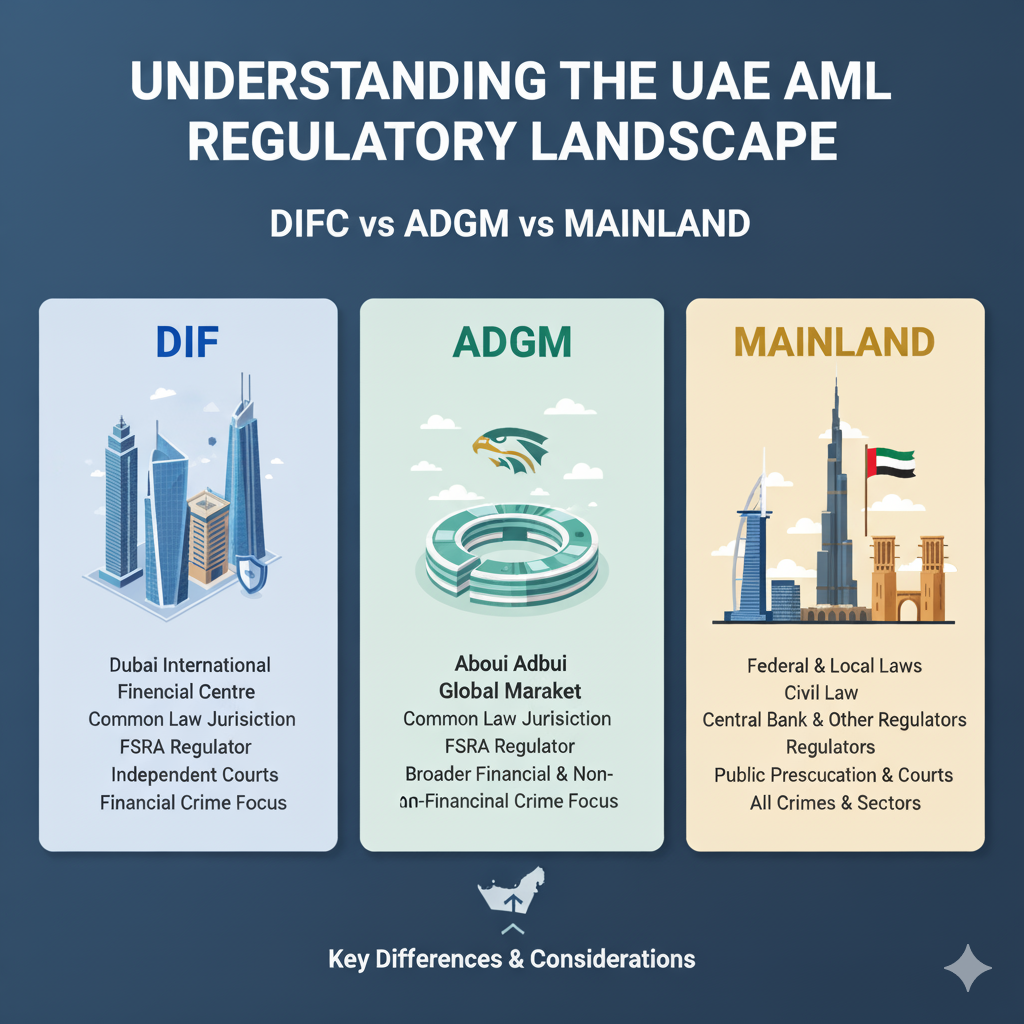

If you are running a business in the UAE or planning to enter this vibrant market, understanding the Anti-Money Laundering (AML) regulations is essential. The UAE has become a global hub for business and finance, which brings significant responsibilities, especially when it comes to preventing financial crimes like money laundering and terrorism financing. In this blog, we’ll break down the AML regulatory landscape in the UAE, focusing on the three main jurisdictions: DIFC, ADGM, and the UAE Mainland. We’ll explain the key differences, helping you understand where and how your business needs to comply with the rules.

What Is AML and Why It Matters

AML stands for Anti-Money Laundering. These are laws and regulations aimed at stopping people from using illegal funds by making them appear legitimate. Common sources of such illegal funds include drug trafficking, corruption, tax evasion, and terrorism.

Every business operating in sensitive sectors — like finance, real estate, or trading in precious metals — must have strong AML compliance services in place. This protects not only the business itself but also the wider economy, maintaining the UAE’s reputation as a transparent and trusted business destination.

DIFC — Dubai International Financial Centre

DIFC is one of the UAE’s top financial hubs, offering a unique legal framework based on English common law. The Dubai Financial Services Authority (DFSA) regulates AML compliance in DIFC.

Key Requirements in DIFC:

- Customer Due Diligence (CDD): Firms must thoroughly verify their customers’ identities and understand their business intentions.

- Ongoing Monitoring: Businesses are required to monitor customer transactions regularly and report anything suspicious.

- Suspicious Activity Reporting: Any suspicious transactions must be reported to the DFSA without delay.

- Compliance Officer: Every company must appoint a dedicated compliance officer to manage AML procedures.

DIFC mainly serves banks, investment firms, and insurance companies, making it ideal for businesses focused on financial services.

ADGM — Abu Dhabi Global Market

ADGM is a financial free zone in Abu Dhabi, operating under its own independent legal system. The Financial Services Regulatory Authority (FSRA) is responsible for AML in UAE oversight.

Key Requirements in ADGM:

- Clear AML Framework: ADGM aligns its rules with international standards like those from the Financial Action Task Force (FATF).

- Regular Customer Checks: Companies must regularly update customer information and monitor transactions for unusual patterns.

- Reporting Suspicious Transactions: Firms must report suspicious activities to the ADGM Financial Intelligence Unit (FIU).

- High Transparency: ADGM offers clear and well-documented compliance requirements.

Why This Matters for Your Business

When operating in the UAE, selecting the right jurisdiction is crucial for compliance and business success. If you are in financial services, DIFC or ADGM is typically the better choice because of their clear regulatory frameworks. Real estate agents, precious metal traders, and law firms generally fall under the UAE Mainland’s rules.

Non-compliance can lead to fines, reputation damage, and even suspension of business licenses. That’s why it’s important to understand your AML Services UAE obligations from day one.

In addition to clarification requests, businesses should also consider the benefits of joining industry groups or associations. These organizations often provide resources, training, and networking opportunities that can help you stay informed about the latest tax developments. Collaboration with peers can lead to shared insights and solutions for common tax challenges.

How to Stay Compliant

Regardless of the jurisdiction, here are important steps every business should follow:

- Appoint a Compliance Officer to handle all AML matters.

- Create a Written AML Policy to guide your operations.

- Know Your Customer (KYC) by verifying customer identity and purpose of transactions.

- Monitor Transactions continuously for suspicious activities.

- Report Suspicious Transactions to the right authority promptly.

- Train Employees regularly on AML procedures and red flags.

ADGM is preferred by fintech companies, asset managers, and professional service providers looking for a supportive regulatory environment.

Conclusion

The UAE’s Anti Money Laundering regulations are designed to ensure businesses operate transparently and prevent financial crimes. Understanding the differences between DIFC, ADGM, and the Mainland helps you choose the right setup for your business.

Following the correct AML procedures protects your business and contributes to the UAE’s reputation as a trusted global hub. Stay proactive, stay compliant, and ensure your business thrives in this dynamic market.