Running a business in the UAE comes with exciting opportunities but also responsibilities. One of the most important responsibilities is staying compliant with regulations, especially those related to Anti-Money Laundering (AML) and financial transparency. Regulators in the UAE, such as the Central Bank, the Ministry of Economy, and free zone authorities, often carry out audits or inspections to make sure businesses are following the rules.

For many businesses, the thought of a regulatory audit can feel stressful. However, with the right preparation, you can face it with confidence. In fact, a well-handled audit can even strengthen your company’s reputation. Let’s look at how UAE businesses can prepare effectively.

Understand Why Audits Happen

Audits and inspections are not meant to disrupt your business. Instead, they ensure that companies operate in line with UAE laws and international standards. The UAE has become a major global hub for finance and trade, which means regulators need to prevent risks like money laundering, fraud, and financing of terrorism.

If your business is in a regulated sector — such as financial services, real estate, or precious metals — you are more likely to face inspections. However, even small and medium enterprises (SMEs) can be reviewed to check whether they have proper compliance measures in place.

Know the Key Areas Regulators Review

To prepare well, you need to know what regulators usually look for. Common areas include:

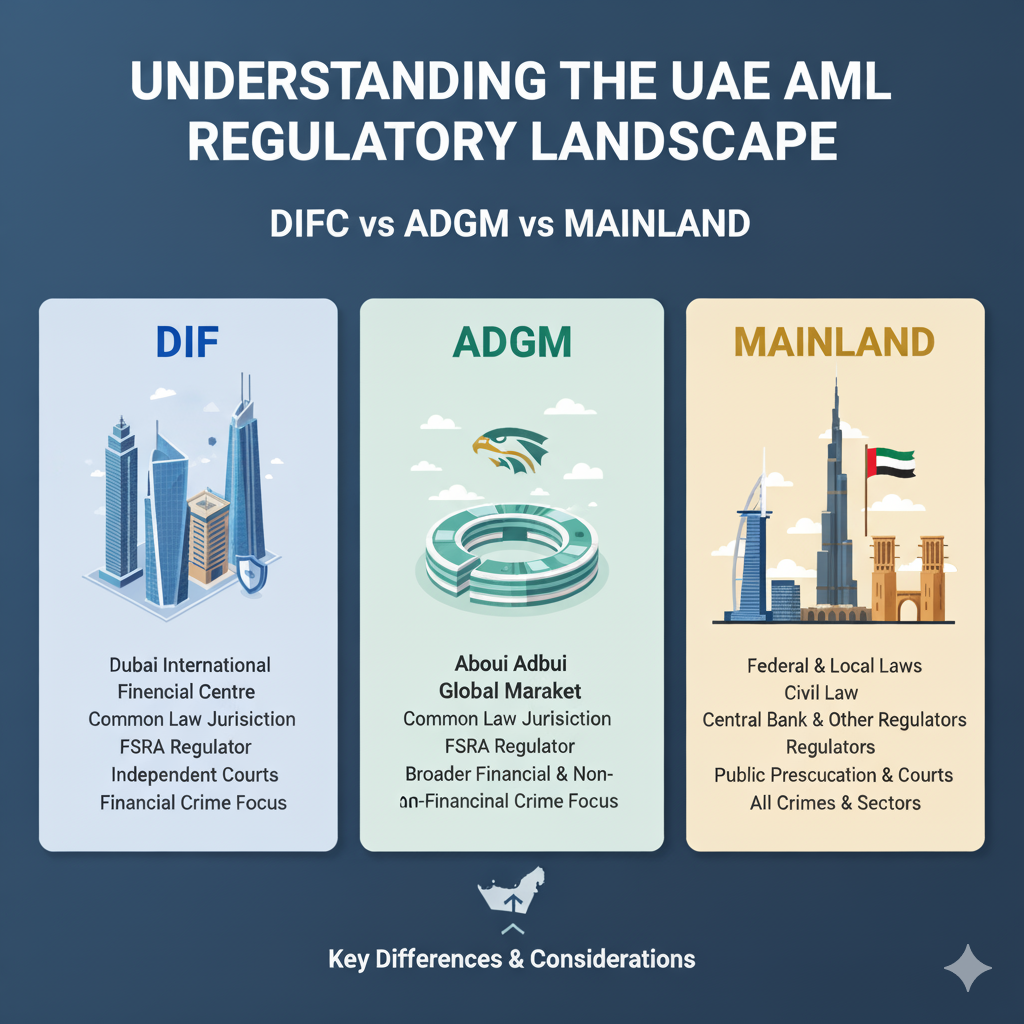

Key Requirements in DIFC:

- Compliance with AML rules: Have you carried out customer due diligence and kept proper records

- Policies and procedures: Do you have written internal policies that align with UAE regulations?

- Training: Have your employees been trained to detect and report suspicious activities?

- Risk assessment: Does your business regularly check for risks related to financial crimes?

- Reporting: Have you submitted any required reports, such as suspicious transaction reports, on time?

By focusing on these areas in advance, you can reduce the chances of being caught unprepared.

Steps to Prepare for an Audit

1. Keep Your Records Organized

Regulators expect businesses to maintain clear and accurate records. This includes customer details, transaction histories, invoices, and contracts. Make sure all documents are updated, easy to access, and stored securely. Having a proper filing system — whether digital or physical — can save time during an inspection.

2. Review Your Policies and Procedures

Your internal policies should reflect UAE laws on AML and other compliance areas. Go through your company policies and update them if needed. For example, ensure that your “Know Your Customer” (KYC) procedures match the latest requirements. Outdated policies can raise red flags during an audit.

2. Review Your Policies and Procedures

Your internal policies should reflect UAE laws on AML and other compliance areas. Go through your company policies and update them if needed. For example, ensure that your “Know Your Customer” (KYC) procedures match the latest requirements. Outdated policies can raise red flags during an audit.

3. Train Your Employees

Employees are often the first line of defense against compliance risks. Regulators may ask them questions during an audit to check their awareness. Regular training sessions on AML compliance, suspicious activity reporting, and data security will prepare your team to respond confidently.

4. Conduct Internal Audits

Don’t wait for regulators to point out gaps. Carry out your own internal audit from time to time. This exercise can help you spot weaknesses early. You may also consider hiring external consultants who specialize in AML services in the UAE to review your systems and provide guidance.

5. Prepare for Interviews

During inspections, regulators may want to meet with key staff members, such as compliance officers or managers. Make sure they are ready to answer questions clearly and honestly. Encourage them to stick to facts and avoid guessing when they are unsure.

6. Stay Updated on Regulations

UAE laws and guidelines evolve regularly, especially in the area of AML compliance. Subscribe to updates from regulators, attend industry workshops, or work with professional advisors. Staying informed will help you adjust quickly and remain compliant.

What to Do During the Audit

When the audit begins, cooperation is key. Welcome the auditors professionally, provide requested documents quickly, and ensure that meetings run smoothly. Avoid delaying tactics or hiding information, as this can create unnecessary suspicion. If the auditors point out minor issues, treat them as opportunities to improve rather than as failures.

The Benefits of Being Prepared

Preparing for a regulatory audit is not only about avoiding penalties. It also strengthens your company’s image in the market. Businesses that follow strong compliance practices earn trust from regulators, investors, and customers. They are also more likely to build long-term success in the UAE’s competitive business environment.

Final Thoughts

Regulatory audits and inspections are part of doing business in the UAE. While they may seem challenging, they are also a chance to show that your company takes compliance seriously. By keeping records organized, updating policies, training employees, and staying informed, you can handle audits with confidence.

A proactive approach to compliance will not only protect your business from risks but also position it as a trustworthy and responsible player in the UAE market.